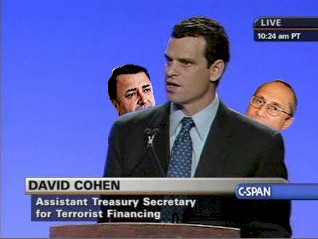

The Treasury Department’s assistant secretary David Cohen addressed the American Bankers Association on Monday. Cohen implored the assembled executives to understand that money laundering sometimes involves “good money being put to bad use,” a standard the G7 Financial Action Task Force adopted way back in 1989. Cohen outlined Treasury’s efforts to “detect, deter and deny” money launderers access to the financial system by naming and shaming “facilitators” from the Gulf petroleum producers to Mexico. He also warned that there would be “reputational and legal consequences” for banks that didn’t pull at the yoke of expanded Treasury powers assumed under Executive order 13224 (PDF).

Audience members were visibly uneasy during camera pans. There was little interest in questioning the Treasury’s new employee. Perhaps with good reason. James G. Carr, the chief federal judge in northern Ohio, recently ruled that Treasury was acting unconstitutionally when it froze a US charity under suspicion of terrorist ties. US courts are only beginning to weigh in on the vast new powers assumed by Treasury. Until now there has been little visibility into its overseas activities. Treasury maintains that the Bank Secrecy Act, a money laundering law, empowers it to deny FOIA requests.

If Cohen and his AIPAC approved mentor Stuart Levey truly wish to test their ability to fight the largest unaddressed remaining terrorism motivator in the Middle East, they could score a “slam dunk” without trampling on the Constitution or even leaving US shores. Since 1977 US nonprofit charitable corporations and individual donors have helped launder $50-60 billion into illegal West Bank settlements, violating US criminal statutes and Israeli laws. If Cohen wants to “name and shame” the kingpins financing the construction that undermines the Obama administration’s policy, he can start with bingo entrepeneur Irving Moskwitz and diamond magnate Lev Leviev.