Special Report

By Grant F. Smith

THIS SUMMER Tobacco Region Revitalization Commission Executive Director Evan Feinman struck a corrupt deal with Virginia Israel Advisory Board (VIAB) Vice Chairman Charles Lessin. Virginians emerged with $210,000 less in funding for legitimate economic development initiatives, even as VIAB forges even bigger deals to benefit Israeli companies. Other Israeli recipients of VIAB-orchestrated state grants include Sabra Dipping Company, AquaMaof, Energix, Alony Hetz and military contractor Oran Safety Glass.

Virginia and other states settled lawsuits against major tobacco companies in 1998. The estimated revenue over the first 25 years of the settlement is $246 billion. Unfortunately, most states spend less than 3 percent of their settlement payouts on adult smoking cessation programs or preventing kids from smoking. These were the intended purposes of the damage settlement.

In Virginia, a large portion of the tobacco settlement funding is distributed by a 28-member body created in 1999 now called the Tobacco Region Revitalization Commission. The commission’s mission is economic and infrastructure development. TRRC has awarded more than 2,000 grants totaling over a billion dollars across Virginia’s tobacco region. Recipients have built university medical and health science centers, broadband telecommunications networks and funded many new business startups.

Private companies, in partnership with county economic development agencies, sign performance agreements that obligate them to create a guaranteed number of jobs within a fixed time period as a condition for receiving grants. Those who are successful (and others who are not) often return to the commission’s Tobacco Region Opportunity Fund, or TROF, for multiple payouts.

The Virginia Israel Advisory Board, or VIAB, is presently the only U.S. taxpayer-funded state government Israel export promotion council in the U.S. As detailed in the article about Sun Tribe Solar, on pp. 28-31 of the November/December 2019 Washington Report, VIAB board members often hold equity stakes and positions as corporate officers in Israeli companies or joint ventures seeking to start operations in Virginia.

In 2014, just after the Israeli company AquaMaof teamed up with VIAB insiders to land a $1.5 million TROF grant to start a fish farm (Something’s Fishy About AquaMaof’s “Project Jonah” in Virginia), VIAB Vice Chairman Charles Lessin suddenly decided to jump into the biofuels business.

Lessin, known locally as the “bingo maven” for his massive Pop’s Bingo World parlor on the outskirts of Richmond, had no experience in the energy industry. Nevertheless, with fuel prices topping $100 per barrel, in 2014 Lessin teamed up with the Israeli company TransBiodiesel to convert an empty former furniture plant in St. Paul into a biodiesel manufacturer. TransBiodiesel uses enzymes to convert waste feedstocks into fuel.

Like all VIAB projects, Lessin’s Appalachian Biofuels LLC sought massive state subsidies. Lessin was seeking $800,000 from the Virginia Coalfield Economic Development Authority and $300,000 from the Virginia Department of Rail and Public Transportation to extend freight rail access to his plant. The Tobacco Commission provided a $565,000 grant for Lessin to work with Russell County economic development officials to bring the plant online.

There were strings attached to the TROF grant. In a detailed performance agreement, Lessin promised there would be a $3.5 million infusion of private equity into the deal, and that 40 people would be employed at an average annual wage of $37,000 within three years. Lessin transferred funds to TransBiodiesel for enzyme purchases and other aspects of the deal.

However, by 2016 petroleum prices had collapsed to under $30 per barrel. Lessin privately informed the Tobacco Commission that a “drastic decline in world oil prices” meant that the project could not move forward. But that didn’t mean Lessin was off the hook. Early in 2017, the Tobacco Commission notified Lessin that Appalachian Biofuels LLC now had to pay back the $565,000 grant. During a January 2018 Tobacco Commission Executive Committee meeting Lessin pled for a reduction in the “claw back” amount. Tobacco Commission Executive Director Evan Feinman joined in Lessin’s plea for leniency in opening statements: “…You know, business is not a guarantee. And often a company with all good intentions and all the right efforts just doesn’t get where they need to get. And that’s fine. And sometimes companies truly have a good story. And in the past this committee has—or commission has—released them of their obligations.”

But Tobacco Commission Executive Committee acting Chairman Frank Ruff, a Republican member of the Virginia Senate, was unconvinced, stating, “Certainly, in economic development sometimes things go right, sometimes things go wrong. If things had gone right, Chuck [Lessin] would have been financially better off.” During the hearing, Ruff appeared to resent what he saw as “leverage” being applied by Lessin against the Executive Committee.

In testimony, Lessin’s legal counsel informed the Executive Committee that when Appalachian Biofuels LLC’s viability was undermined by collapsing energy prices, Lessin had transferred $355,000 into a trust fund held by a law firm handling Russell County economic development funds. An examination of tax records reveals that these funds appear to have originated from a nonprofit tax-exempt charitable umbrella organization for Lessin’s gambling enterprises, The Jerusalem Connection. The Jerusalem Connection was founded to “help to combat the worldwide problem of [Jewish] assimilation” and raised funds for Birthright Israel. The owner of the law firm involved in the deal had ties to a Tobacco Commission scandal involving state Senator Phillip Puckett that was investigated by the FBI. (See the new book, The Israel Lobby Enters State Government: Rise of the Virginia Israel Advisory Board for details).

Chairman Ruff questioned Lessin’s attorney about the transaction. “What is the reason for the $355,000 staying in escrow and not coming back to the commission?”

Lessin’s lawyer told Ruff, “Well, I think we had to have a conversation around what does a final resolution look like.”

Ruff did not like this response, charging, “You wanted some leverage, is that my understanding of what you just said?”

Ruff then issued the Executive Committee’s final ruling directly to Evan Feinman. “If you can sit down…and figure out anything, that would be the best route to take. Because I’ve heard no motion [to alter the full repayment], we can’t do anything.” The appeal for leniency formally denied, on Jan. 22, 2018, Lessin had $355,000 of the grant transferred from the law firm back to the Tobacco Commission.

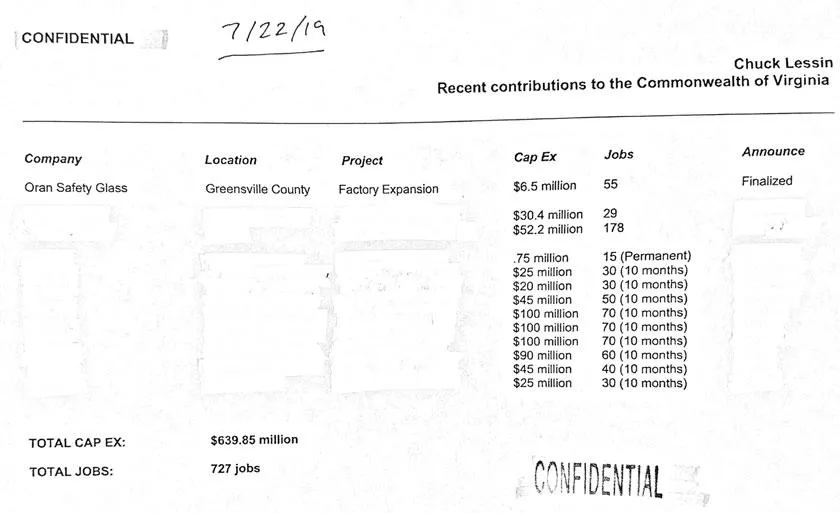

But Lessin was in a bind. He still owed $210,000 and any withdrawal from The Jerusalem Connection would look suspicious. In February 2018 Lessin made an entirely new pitch to Evan Feinman and select staffers at the Tobacco Commission. He asked the Tobacco Commission to forgive his $210,000 payment obligation because as Vice Chairman of the Virginia Israel Advisory Board, he was creating an enormous number of jobs and tax revenues within the Tobacco Commission “footprint.” Feinman and staffers requested proof. After Lessin provided a list (pictured above), Feinman agreed to forgive the $210,000 claw back, telling Lessin in an Aug. 5, 2019 letter:

In a February 2018 meeting with between (sic) TRCC staff and yourself, it was agreed that in your capacity as a member of the Virginia Israel Advisory Board, over a two-year period, you would work to meet the performance metrics promised as part of project 2941 (40 new jobs, capital investment of $3.5M) to the Commission’s footprint.

In July 2019, at the request of TRRC staff you provided a detailed confidential listing of the projects you have (and continue to be) involved with that are within the Commission footprint. After reviewing the locations, capital investment and jobs provided with these projects, TRRC staff can confirm that you have fully met the employment and capital investment obligations as agreed and the project can be closed. Thank you for your partnership with the Commission and please be in touch should you have any follow up questions.

It did not appear to bother Feinman that Lessin had no personal equity stake in any of the VIAB projects, most details about which the Tobacco Commission carefully redacted before releasing them under the Virginia Freedom of Information Act in September. The TROF performance agreement—like all such agreements—specifically forbade counting the job and tax metrics of other TROF grantees such as Oran Safety Glass, which appears on the list, against grantee Appalachian Biofuels LLC’s commitments. Other records also indicate neither Feinman nor staffers ever sought approval of or even disclosed the deal at five subsequent meetings of the Tobacco Commission Executive Committee. Also, of no concern to Feinman were growing doubts about the Virginia Israel Advisory Board’s jobs and economic development claims. Former Virginia Secretary of Commerce Todd Patterson Haymore in 2018 characterized them in an internal email as “inflated without merit.”

Instead, the Virginia Israel Advisory Board continues to funnel millions of TROF and other state economic development funds into dubious Israeli projects with heavy VIAB insider involvement, confident that accountability will never loom on the horizon.

Grant F. Smith is the director of the Institute for Research: Middle Eastern Policy in Washington, DC. To view files received via the Virginia Freedom of Information Act to produce this report, visit the Israel Lobby Archive at https://IsraelLobby.org/biofuels. View videos and transcripts about the Virginia Israel Advisory Board presented by the Virginia Coalition for Human Rights at the National Press Club (pp. 59-66 of the May 2019 issue of the Washington Report). Smith’s latest book, The Israel Lobby Enters State Government, is now on sale at Middle East Books and More.