AN ISRAELI FISH FARMING project in southwest Virginia—key details of which were long kept secret—is experiencing some local skepticism just as earth moving begins to dramatically alter the rural landscape. A key project booster, House of Delegates member Will Morefield (R-3rd District) in October told Cardinal News that, “There were many nights where I was on the phone at 11, 12, past midnight, trying to explain to people that the project was not dying.”

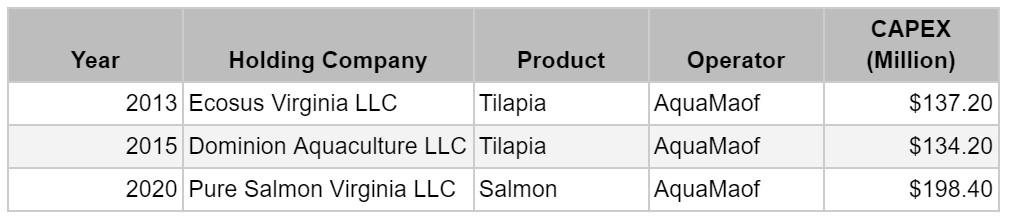

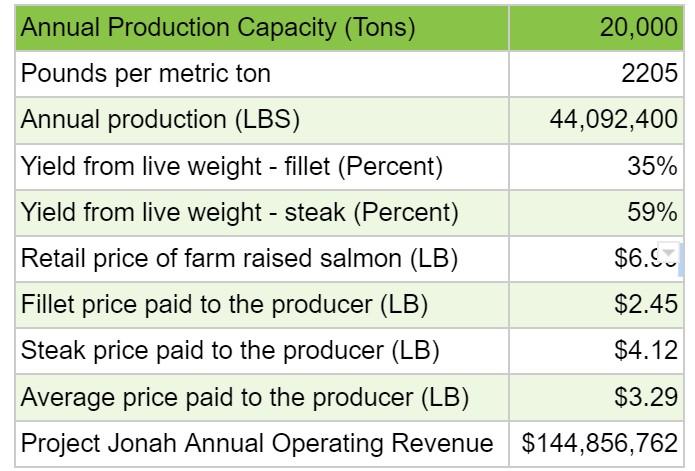

Originally a tilapia growing venture, Project Jonah will now attempt to raise and bring to market 20,000 tons per year of Atlantic salmon. During the project’s tilapia phase (2013-2019), it was claimed that the nearby headquarters of the Food City supermarket chain would buy and distribute the fish—a key comparative advantage.

This time around, the public “offtake” case for the new Pure Salmon initiative—whether fillets, steaks or even smoked lox—has not publicly been made, even to grant makers such as the Virginia Economic Development Partnership. Pure Salmon’s buildings will cover an area the size of 13 football fields and Project Jonah advocates from three county governments (Buchanan, Russell and Tazewell) as well as the Commonwealth Opportunity Fund have executed performance agreements requiring up to 281 high paying jobs and $198 million in capital investment.

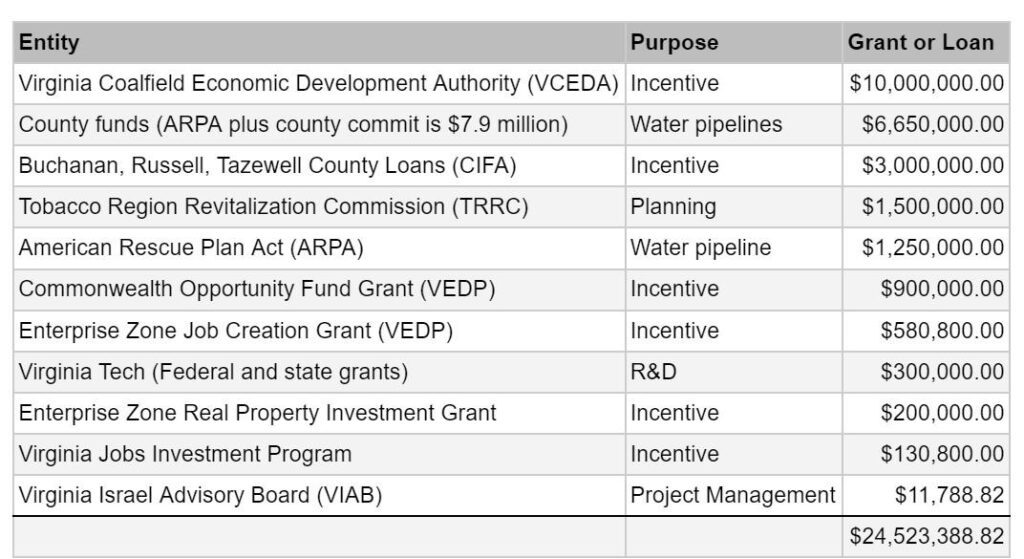

However—strictly defined—relatively little non-government money appears to be slated for Project Jonah. The key behind-the-scenes organizer of the project, the Virginia Israel Advisory Board (VIAB), which was created and statutorily led through mandatory board seats by Virginia’s Jewish federations, long kept the location, ownership, source of capital and other key aspects of the project under wraps. In a 2013 board meeting, VIAB emphasized the reason behind all the secrecy was that “leaked information could jeopardize funding opportunities from the state.”

As murky as some aspects of Project Jonah have been, it is now clear that VIAB’s overall objective since 2013 has been to benefit a single Israeli startup company—AquaMaof—which has no proven capability to execute its biggest ever project. AquaMaof has been the designated winner, despite Virginia being home to other established, unsubsidized, successful private aquaculture companies. Public funding committed to the project now totals nearly $25 million, with much more to come for worker training and other phases. In April, Southwest Virginia Community College executed a memorandum of understanding with Pure Salmon to train technicians, costing $1,929 per certification. If 218 workers complete the coursework, the Virginia Coalfield Economic Development Authority (VCEDA) is expected to reimburse the $420,522 in costs to Pure Salmon, which may run an on-campus education entity.

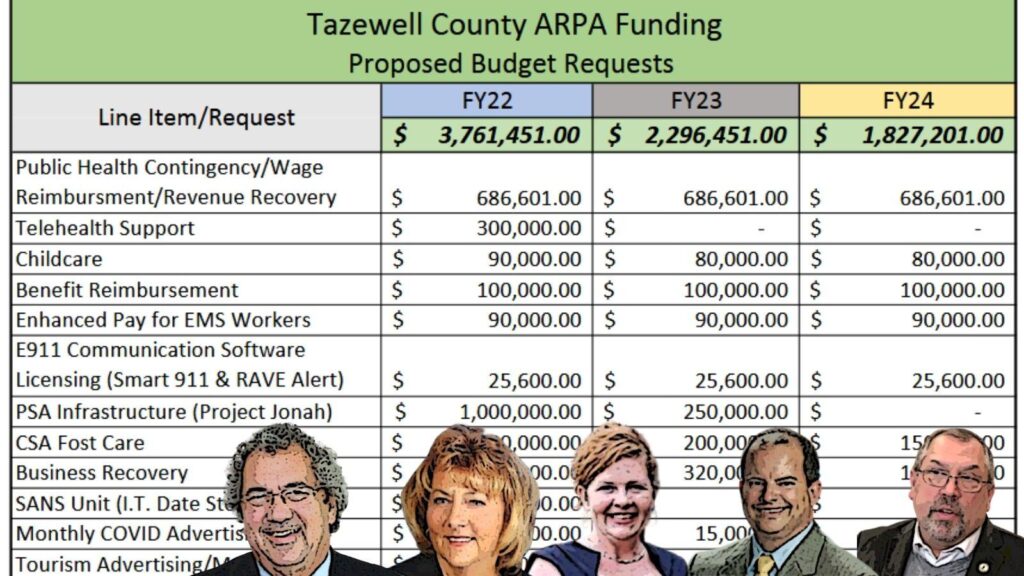

Concerned citizen Connie Kitts attended a regularly scheduled Tazewell County board of supervisors meeting in Southwest Virginia on August 3, and spoke on the need for a substance abuse recovery center. With the region already at crisis levels from pervasive substance abuse, the COVID-19 pandemic has made the situation even more desperate. The American Rescue Plan Act (ARPA) makes $350 billion available for cities and counties and is intended in particular to support government services negatively impacted due to the COVID-19 public health emergency while leaving open other uses for the funding.

But the Tazewell County Board of Supervisors made other plans. When the board laid out its intended distribution of federal dollars from ARPA, they earmarked $1 million, or 27 percent of the FY22 allocation to support Project Jonah water pipeline construction, overlooking the need for substance abuse programs.

The earmarked funds would build miles of new water pipeline from the Town of Richlands water treatment plant—the original location of the fish farm—to support Project Jonah in the valley just below Southwest Virginia Community College. Earlier in June, the board of supervisors had emerged from a closed session and voted to hire Virginia lobbyist David Bailey to secure additional Project Jonah funding from the state legislature.

Tazewell County Supervisors Michael Hymes, Maggie Asbury, Shanna Plaster, Charles Stacy and Thomas Lester agree to spend $1.25 million ARPA out of a $7.9 million county commitment to upgrade water systems for Project Jonah. No public input or vote was held. Initial plans for the fish farm were organized by the Virginia Israel Advisory Board in 2013. The only state agency in the U.S. devoted solely to promoting Israeli companies from within a state government, VIAB hired a team to put together a business plan that counted on millions in startup funding from state economic development agencies like the Virginia Coalfield Economic Development Commission (VCEDA) and Tobacco Region Revitalization Commission (TRRC). Both agencies are dedicated to rebuilding southwest Virginia after devastating declines in tobacco farming and coal mining.

During 2020 reviews of the project by the Virginia Department of Environmental Quality, Project Jonah officials quietly told DEQ watershed and storm runoff experts that the project was staging construction phases to maximize the amount of government funding committed to the project. Peak water requirements will rely on 400,000 gallons per day in new capacity from the Township of Richlands water treatment plant to fill tanks as well as occasional flushing and cleaning. That capacity in turn depends on the already heavily burdened Clinch River and a nearby reservoir.

VCEDA repeatedly extended loan closing dates and even made the proposed loan partially forgivable, as requested by Project Jonah, after years of delayed groundbreaking and other project milestones, such as execution of a worker training program at nearby SWCC.

In the past, Tazewell County built some spectacular white elephants in the name of economic development that produced few jobs but siphoned away scarce county funding. One was the 680-acre Bluestone Regional Business and Technology Center. Built in 2017 with VCEDA funding, the $13 million tech-startup ready shell facility has stood empty for years as county executives debated whether additional expenses such as paving the crushed stone parking lots might finally draw in startups and young tech-savvy entrepreneurs. Only one small fish bait company currently occupies the vast acreage.

Tazewell County’s dreams and “go-getter” economic development push have been further elevated by its new director of economic development Timothy Danielson. In 2019 Danielson left the Midland Development Corporation in Texas, following allegations of lavish business expense spending, after a failed bid to turn the city airport into a “commercial spaceport.“

On Sept 7, concerned citizen Connie Kitts returned, submitting ten written questions about the diversion of funds to “Project Jonah” and requesting answers before the county board of supervisors next convened. These included questions about how much Project Jonah would draw away from county substance abuse programs, why fully 27 percent of ARPA funds were going into a private fish farm, whether the operator was competent and if the fish farm would negatively impact the environment, especially rivers and streams. (Transcript of audio).

Due to the project’s secrecy there was limited local investigative news reporting. The project’s jobs and economic benefit promises also make public criticism difficult. While the Board of Supervisors promised a written response by the next meeting, County Administrator Eric Young called the questions an “attack” and was granted permission to immediately respond “for the benefit of the media.”

Young served as county attorney in 2006 until being confirmed by the Board of Supervisors as administrator early in 2019. Young is also the author of a 2012 dystopian science fiction novel titled The Unreconciled, in which “a caliph rules America after the Christian Holocaust.”

The book may reflect the world view of Eric Young. As an undergraduate, Young focused his studies on the politics of the contemporary Middle East. In 2014 Young urged on the Facebook promotional page for the book, “If ISIS and Ebola surprise you, you have not read The Unreconciled…Get a copy if you haven’t read it. If you have, get a copy for someone who hasn’t. Read it. See it. Stop it from happening here.” Other Facebook posts further tie the novel to current events.

During the Sept. 7 meeting, Young claimed that, “as far as the funding, Pure Salmon provided to VEDP verification from an independent accounting firm that they had in fact secured $300 million in investment and secured loans for the project. So they have $300 million of the estimated budget. It is somewhere between $130 to $150 million for the construction costs.”

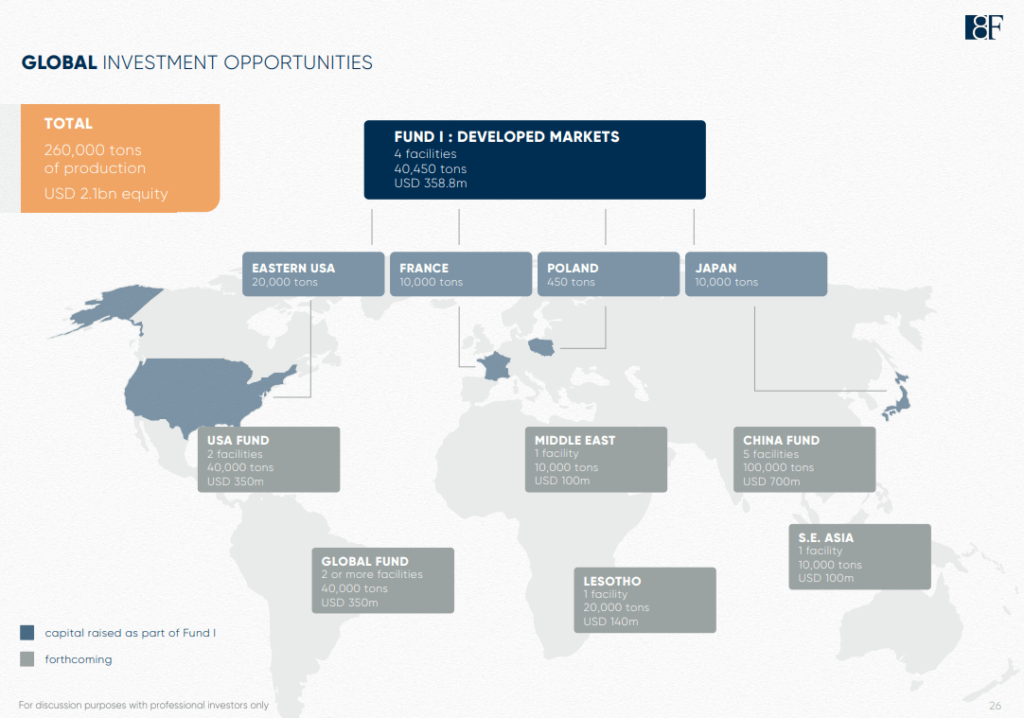

When asked for the accounting report on Project Jonah’s committed capital via a state Freedom of Information Act, VEDP could not produce one. VEDP does have a “capital commitment proof letter” from Singapore-based Apex Fund Services in 2020, which allegedly administers the 8F AquaCulture Fund I, self-certifying that it has a “total commitment” of $317 million. Notes from a Cantor Fitzgerald (a financial services firm) branch in Japan indicate that “construction period debt financing is tricky, would prefer to do a refinance when [the] construction is underway.” Cantor also noted the lack of an offtake agreement like the Food City deal during Project Jonah’s tilapia phase. “Important that the U.S. project has an offtake agreement.”

In a response to the questions published in the Tazewell County Talk page of the October 6 edition of The Voice, which was based on an Oct. 5 written response to the Sept. 7 meeting, Young dropped his references to an accounting report. In addition to no accounting report on file, that may be because even if 8F certifiably did raise $358.8 million, as it claims, according to 8F’s own internal “road show” slide presentations made to investors, when allocated among all of the investment bank’s other developed country aquaculture programs, only about $119 million, not the entire multi-project fund, would theoretically be available to Virginia. That is still $79 million short of the current capital expenditure commitment to Virginia’s VEDP.

Despite the focus on job creation and increased tax revenues, the record reveals only one entity was ever really intended to benefit from “Project Jonah”—the Israeli company AquaMaof. In 2013, David Hazut was listed as CEO of Ecosus Virginia, LLC , a company incubated inside the Virginia Tech Corporate Research Center in Blacksburg, Virginia, both consuming and applying for development grants. Today David Hazut has fully emerged as CEO of AquaMaof Aquaculture Technologies, Ltd.

Original Project Jonah plans had AquaMaof using its patented recirculating aquaculture system (RAS) to grow tilapia. AquaMaof’s main patent was acquired from Minnesota inventor Gary Myers in 2016. Only much later did Project Jonah promoters shift to salmon, a very different product with a separate, more complicated, set of production challenges. Tilapia are hardy and typically farmed in 70-80°F water and are often grown in uncovered outdoor ponds. Farmed inland salmon require covered refrigerated tanks regulated to 46-57°F, meaning extra power is required in many locations. And as even County Administrator Young pointed out during the September hearing, onsite desalination is needed before returning wastewater to treatment plants.

Project Jonah boosters never publicly disclosed who holds the “stock,” or ownership in AquaMaof. It turns out the Gilad Shabtai Group controls AquaMaof. Some of Gilad Shabtai’s capital was formed by Tel Aviv born, Israeli American citizen Benny Shabtai, the exclusive U.S. distributor of Raymond Weil luxury Swiss watches. Benny and his brother Gilad provided startup capital to the cross-platform voice and instant messaging service Viber. The 2014 sale of Viber to Japanese e-commerce company Rakuten netted the group a half billion dollars in exchange for their 52 percent equity stake in Viber.

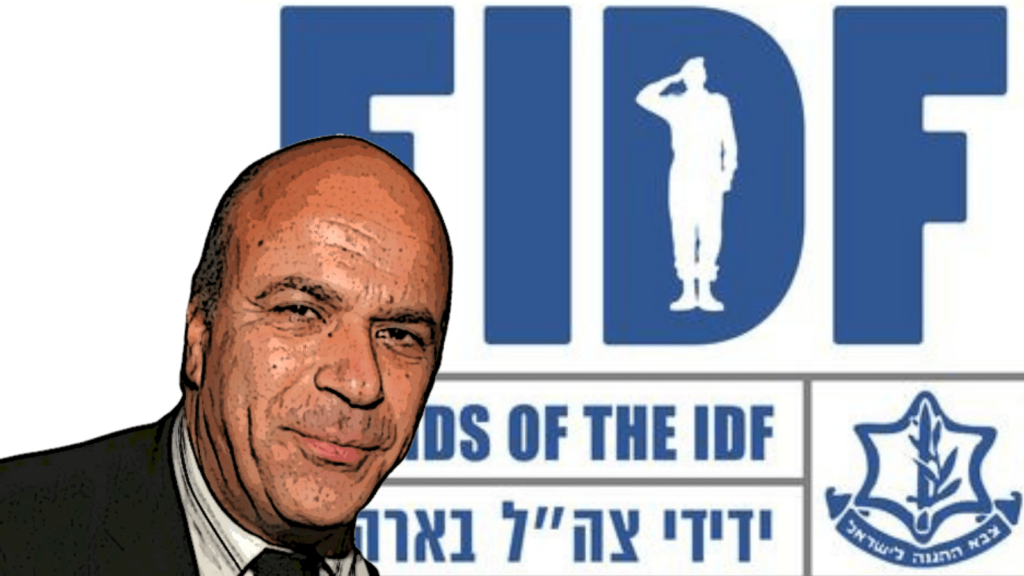

A former IDF soldier who fought in the 1973 Yom Kippur War, Benny Shabtai plowed some of this wealth and energies into the American “charity” Friends of the Israel Defense Forces, established in 1981. FIDF raises tax-exempt donations in the U.S. to build recreational facilities and other creature comforts for soldiers on Israeli military bases.

Benny Shabtai chaired FIDF gala events at the Waldorf Astoria hotel in New York from 1996 to 2012, sometimes raising $23-26 million at each dinner. For Shabtai, “educating” the American people about “the sacrifices of young Israeli soldiers and the dangers they experience” was his “greatest success…It’s the best thing I’ve ever done in my life. The issue is very close to me.” Over the past two decades, FIDF raised $1.2 billion in the U.S. to support Israel’s soldiers.

In 2014 Benny Shabtai also donated funds to purchase a $1.5 million mansion for a Yale University society, co-founded in 1996 by then student, now Senator, Cory Booker. Shabtai is an exclusive society that aims to shape future Jewish and non-Jewish leaders on Yale’s campus. In 2012 Booker lauded the IDF as “the most courageous men imaginable” at a Shabtai event gathering U.S. politicians and Israeli officials to celebrate the release of IDF soldier Gilad Shalit. Shalit had been kidnapped by Hamas and held for five years until a prisoner exchange.

Inland salmon farms are a complex and risky business where small mishaps can quickly cascade into catastrophe. In March this year the Atlantic Sapphire RAS facility in Miami suffered a “mass-mortality” event possibly due to “elevated turbidity.” It also suffered yet another loss of 200,000 salmon at a farm in Denmark over high nitrogen levels. The publicly traded company is the leading land-based aquaculture company in the world but produced net losses of $51.5 million in the first half of 2021, wiping out a quarter billion dollars in market capitalization. That forced the company to consider switching production to rainbow trout in the Miami facility.

AquaMaof has also not been immune to die-offs, mistakes and potential financial consequences. An Israeli fish farm company operating in the Negev sued AquaMaof in 2020 over a mass die-off it blamed on AquaMaof’s technology and general incompetence.

The large-scale inland salmon farming industry is considered by some industry experts to be a risky business. One veteran fish farmer told the trade publication SeaWestNews, “Nobody is doing it successfully on a large scale…the people behind the mega land-based farms are mostly about raising money, not raising fish.” However, for William Morefield, the huge scale of Project Jonah was not a red flag but proof of viability. “The scale of the project was proof to me that the technology was proven.” Fortunately for AquaMaof insiders, if Project Jonah flops, they likely will not personally bear any personal financial losses because of the careful way it has been structured and capitalized.Project Jonah’s financing is being arranged through the Singapore-based investment bank 8F. 8F, a little known entity composed of Bear Stearns alumni, claims it has closed on over $360 million in funding, suggesting it came from many investors including sovereign wealth funds for its first round of developed market private equity aquaculture ventures. However, the government of the United Arab Emirates seems to be Pure Salmon’s key partner and lead funder.

Pure Salmon’s head office is located in Abu Dhabi in the luxury Al Maryah Island business district. In September, 8F announced in “our newly formed partnership with ADIO in the UAE, we have firmly put Pure Salmon on the map as a world leading provider of sustainable protein.” ADIO is the Abu Dhabi Investment Office, the world’s third largest sovereign wealth fund with $829 billion under management. Most sovereign wealth funds invest state owned revenues from commodity exports, which in UAE’s case is crude oil, into diversified overseas investments. They are closely watched and influenced by their host governments.

According to the Bureau of Economic Analysis, despite its energy wealth, the UAE only has $17.3 billion in foreign direct investment (FDI) in the U.S. Though BEA strives to count ultimate beneficial owners, it is likely it would count any transfers through Singapore-based 8F as FDI from Singapore, which has invested $27.3 billion in the U.S. Routing the capital through Singapore is commonplace for UAE, and may lessen any chance of public backlash against Arab gulf state investment in the U.S. That protection from discrimination may ironically still be necessary because Israel’s U.S. lobby and its allies have in the past successfully blocked UAE from directly investing in the U.S. through public relations and smear campaigns.

In 2006 the British firm P&O, which managed six U.S. ports among other world holdings, attempted to sell them to Dubai Ports World (DP World) of the United Arab Emirates. The UAE company would have controlled management of ports in New York and New Jersey, Baltimore, Philadelphia, New Orleans and Miami. The sale quickly received approval from the U.S. Committee on Foreign Investments but then ran into a hail of fire from neoconservatives and pro-Israel members of Congress.

The American Enterprise Institute’s Michael Ledeen wrote, “As I’ve had occasion to note over the past few years, Dubai is home to billions of mullahdollars, and the black market through which all manner of illegal arms shipments and money-being-laundered have passed.” Peter Brookes at the Heritage Foundation noted that “Critics claim that the UAE recognized the Taliban, and al-Qaeda used it in 9/11 preparations.” Alex Alexiev, of the Center for Security Policy claimed, “From the very beginning in the 1970s, the UAE has been a key source of financial support for Saudi-controlled organizations like the Islamic Solidarity Fund, the Islamic Development Bank (IDB).”

Senator Chuck Schumer (D-NY) joined the charge to scuttle the ports deal, holding press conferences and getting fellow members of Congress to line up in opposition. In March of 2006, a House panel convened and voted to block the deal. Dubai Ports World eventually sold its U.S. operations to American International Group. AIG then imploded during the 2008 financial crisis and was bailed out with $150 billion provided by the U.S. Financial Stability Oversight Council as a systemic risk, or “too big to fail” financial services company.

Israel advocates may be quietly supporting UAE investments in the United States today because of the Abraham Accords.

The Abraham Accords are a pro-Israel policy agenda designed to transcend a rights-based settlement with Palestinians derived from U.N. resolutions and human rights. Nearly a million Palestinians were displaced before and since Israel’s formation. The guiding principle of the Abraham Accords is that economic development packages and “normalization” between Israel and Arab countries, few of which were ever at war with Israel, should be the sole focus of U.S. policy efforts rather than directly brokering an Israel Palestine settlement through diplomacy.

Palestinians during the Trump administration rejected the first Abraham sub-accord dubbed the “Deal of the Century,” which required Palestinians to forfeit sovereignty and territorial rights in exchange for vague and uncertain economic development projects funded by the U.S. and Gulf countries like UAE.

Trump administration Abraham Accord efforts then pivoted toward fracturing remnants of Arab solidarity with the Palestinian cause. The UAE, Bahrain, Morocco and Sudan all quickly agreed to normalize relations with Israel in exchange for various transactions with the United States. For UAE, it was approval for the purchase of $23 billion in advanced jet fighters from the U.S. Sudan signed an accord after former U.S. Treasury Secretary Steve Mnuchin promised to remove Sudan from the U.S. list of state sponsors of terrorism. Since that removal, normalized relations have still not yet been fully realized. Sudan’s government fell to a military coup and it is unclear whether Washington will continue to pressure Sudan to establish relations with Israel before civilian rule is established.

Morocco quickly established relations with Israel and, in exchange, in December 2020 received a U.S. pledge of $5 billion in International Development Finance Corporation funds and recognition of Morocco’s illegal annexation of Western Sahara, a former Spanish desert colony. The Polisario Front, a Western Sahara independence movement, called the act “a flagrant violation of the U.N. Charter.” The U.N., the EU and dozens of other countries had already recognized the Polisario-proclaimed Sahrawi Arab Democratic Republic (SADR). SADR was a full member of the African Union. Nevertheless Secretary of State Anthony Blinken has promised Morocco the U.S. will not reverse recognition of Moroccan sovereignty over the territory.

Another aspect of the Abraham Accords is a “shadowy” $5 billion International Development Finance Corporation funding pool that has mostly been tapped to benefit Israeli companies under the guise of “normalization.” The U.S. International Development Finance Corporation, which is headquartered in Israel, received 25 applications and chose 15 projects for funding. In 2019, DFC committed $480 million to two “Egyptian projects.” In reality these were projects to transport and sell Israeli liquid natural gas from the Leviathan fields being developed offshore in partnership with Noble Energy. By September 2020, Israel had three active projects totaling $580 million in line for U.S.-backed loans. However DFC has gone dark and is not responding to Freedom of Information Act requests for details about proposed and closed deals.

The American Israel Public Affairs Committee (AIPAC) is Israel and its U.S. surrogates’ main instrument for lobbying Congress. AIPAC’s top legislative initiative over recent quarters has been yet another Abraham Accord driven piece of legislation called “The Israel Relations Normalization Act.” The Senate version, S.1061 introduced by Senators Cory Booker (D-NY), Rob Portman (R-OH), Jim Risch (R-ID), Todd Young (R-IN) and Ben Cardin (D-MD) makes the Abraham Accords a top priority across U.S. government agencies. “Abraham Accords as U.S. policy” means AIPAC can lobby the Pentagon for additional arms sales to the UAE, support its war on Yemen or lobby the State Department to flout U.N. resolutions on Morocco not as lobbyists for foreign governments, which require registration and public disclosures at the Department of Justice, but under the guise of advancing the Abraham Accords as a U.S policy.

This is the same type of cover that AIPAC, which constantly meets with and coordinates its lobbying with Israeli government officials, uses to dodge repeated charges that it should be registering as an Israeli government foreign agent. AIPAC claims it lobbies for “a strong U.S.-Israel relationship” and not Israel. However, in 1962 when AIPAC functioned as the lobbying division of the American Zionist Council umbrella organization, the Justice Department ordered the group to register as Israeli foreign agents. Since that time, both the Department of Justice and AIPAC have ignored the very existence of the order.

AIPAC itself was instrumental in hatching Project Jonah. In 2013 AIPAC sent Virginia House of Delegates member James W. “Will” Morefield [R-North Tazewell] to visit AquaMaof facilities in Israel and AquaMaof’s pilot facility in Poland, followed by a delegation of economic development officials from Tazewell County. Morefield remained behind in 2013 for extra days in Israel to meet with the director of the Virginia Israel Advisory Board (VIAB) and, “as a result, we identified aquaculture as one of a few opportunities and from there Project Jonah was born.” The fish tanks in AquaMaof’s Polish facilities resemble huge barrels with rapidly flowing water.

If Project Jonah fails, a precedent exists for passing any losses from AquaMaof through 8F back to UAE. That precedent is the spectacular initial wipeout of the office space sharing company WeWork. WeWork publicly appeared to be funded by Japan’s SoftBank which posted a $17.7 billion loss after the charismatic but incompetent Israeli founder Adam Neumann drove it into the ground. Later it was revealed that most of the capital SoftBank lost on WeWork actually came from Saudi Arabia.

If Pure Salmon’s operation in Virginia does come to fruition, it could produce some desperately needed jobs in an economically depressed region of the state. But AquaMaof, as always intended by Project Jonah’s boosters, is all but guaranteed to net hundreds of millions in operating revenues paid out by Pure Salmon for AquaMaof’s patented RAS technology and overall management of the site. FIDF and AIPAC would also likely receive their cuts through corporate charitable donations. Revenues, not just water, will soon be recirculating.

Although the Tobacco Commission, VCEDA and Commonwealth Opportunity Fund have executed formal performance agreements specifying that in exchange for funding and loans the project must produce 218 jobs paying somewhere near $60k per year and that there will be $198 million in capital expenditures, uncertainty remains. The performance agreements lay ultimate responsibility for repayment in the event of non-execution on the counties which would have to repay loans and grants if Pure Salmon goes bankrupt. In other projects, the Tobacco Commission has been extremely lenient with Israeli companies that fail to deliver.

Oran Safety Glass, an Israeli military contractor brought in to Emporia by VIAB, has repeatedly failed to meet job creation targets and uses large numbers of temporary workers rather than salaried employees. Nevertheless, OSG sponsor Greensville County has been asked to repay nothing and even continued to receive additional Tobacco Commission grants. An Israeli biodiesel refinery operation owned by VIAB Vice Chairman Chuck Lessin was also quietly let off the hook under a suspect deal with Tobacco Commission Executive Director Evan Feinman for hundreds of thousands in grants repayment after the venture failed. The Associated Press reported Tobacco Commission grants often can leave communities on the hook. However, in the face of a string of heavily subsidized, struggling, or like AquaMaof, startup Israeli companies brought into the commonwealth to compete with successful Virginia competitors, entrenched boosters reject probing questions from concerned citizens.

One of Connie Kitt’s September 7, 2021 questions revealed a core problem with Project Jonah in particular and VIAB in general—the preferential treatment given to Israeli over Virginia companies.

If the board of supervisors and IDA [Industrial Development Authority] were convinced that inland fish farming was a good industry for this region, why wasn’t Virginia market leader Blue Ridge Aquaculture ever invited to compete for all the money that you’ve given to Pure Salmon?

Connie Kitts

Eric Young responded that, “we didn’t wake up one morning and say we’re going to build a fish farm in Tazewell county and then go out and find somebody to build it. That’s not the way this happened.” While true, that was probably how it should have happened. After years of secrecy, Project Jonah is being rolled out in a way eerily similar to how the Abraham Accords were sprung on Palestinians. The surrounding southwest Virginia community is supposed to remain quiet and unquestioning in exchange for promised economic development expenditures for which taxpayers will be on the hook if the project fails. To date, it appears Project Jonah will be funded almost entirely with local, state, federal and vast amounts of UAE government funds transhipped through Singapore.