Massive government spending on the US invasion and occupation of Iraq and Afghanistan is fueling inflation that many Americans are encountering at the gas pump. But the new energy crisis is affecting Americans much more harshly than European consumers.

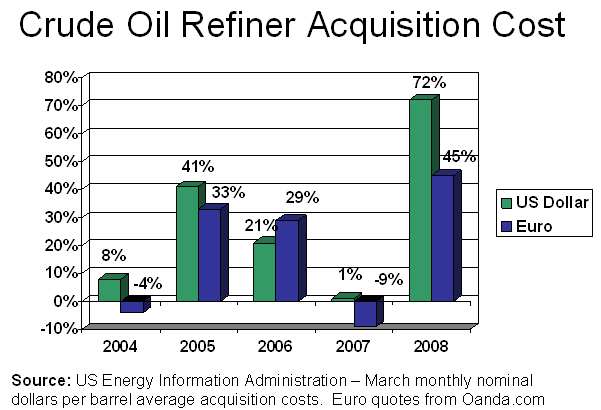

Bush administration fiscal and monetary policies have caused the value of the US dollar to plunge. This has driven international petroleum producers to seek options for trading their crude in more stable currencies, driving down demand for artificial dollar reserves. Skittish international investors are seeking safer and more responsible financial havens for investment. Although generally underreported in the United States, the plunging value the dollar means Americans are suffering disproportionately from war induced inflation. Over the past five years they’ve faced average yearly petroleum cost increases of 29% even as Congress passed subsidies spurring demand for the domestic manufacture of highly fuel inefficient vehicles. Europeans experienced a more manageable 19% average annual petroleum price increase and more options created by heavy EU investment in non-automotive centric transportation infrastructure